Similar Posts

Best time to change your old system

ByHomerThe end of the financial year and the beginning of a new one are always significant periods for businesses – a time for reviewing results, analyzing financial performance, and setting new goals. This period is…

L,L CORRECTOR OÜ is a TOP company, already 5 years in a row!

BylauraOnly 1% Estonian Companies make it to Äripäev TOP. L,L CORRECTOR OÜ is a TOP company, already 5 years in a row!

Report about the beneficial owners of the company

BylauraCompanies registered in the Commercial Register must provide data on beneficial owners by 31 October 2018 at the latest. The beneficial owners of the companies established after August 31, 2018 must be submitted together with…

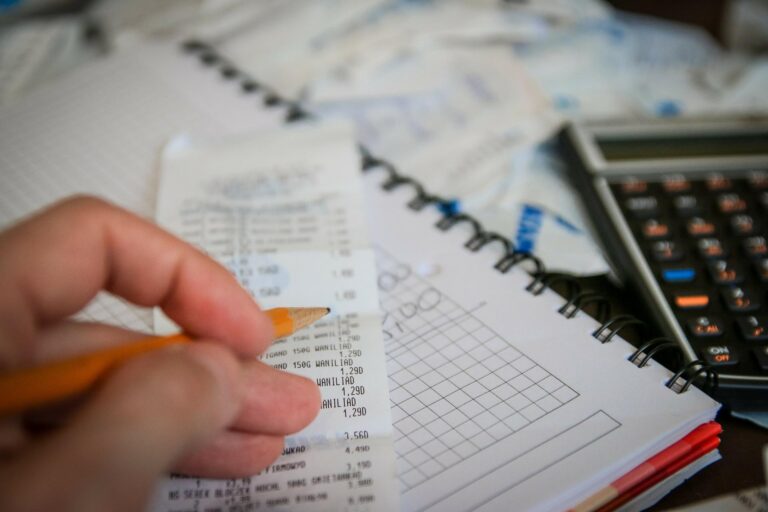

Tax Rates as of 01.01.2026

Withholding income tax on salary: 22%

Tax-free income: 700 euros per month and 8,400 euros per year, regardless of the person’s total income…

Tax rates in 2018

ByHomerTax rates 2018: Withheld tax 20% (TMS § 4 lg 1). Amount of non-taxable income 0…6000 / 12 = 0…500 EUR per month (TMS § 23 lg 1 ja lg 2). Rate for Social Security tax 33% (SMS § 7 lg…

From 01.09.2024, the VAT rate in Finland will change

BylauraFrom September 1, the general VAT rate in Finland will increase from 24% to 25.5%. The new percentage will be applied to goods and services currently subject to a 24%VAT rate. More information: New VAT…